If there’s one thing you can do for your business to help it grow and succeed, it involves streamlining the checkout process to make it easier and more convenient for your customers. As such, if you’re using any of the outdated checkout tools here, it’s time to think about ditching them in favor of some new technology.

Non-Digital Point of Sale Systems

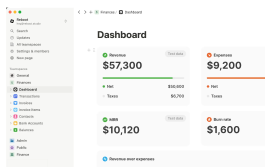

It’s the digital age, and small businesses across the globe are getting on board. Gone are manual point-of-sale systems requiring employees to type serial numbers into a computer and manually remove items from inventory as they’re sold. Today, a simple scan of the barcode is all it takes to input the information your business needs to remain organized. Not only does it allow you to collect payment for that equipment, but it also automatically removes that device from your inventory which makes real-time reporting that much more useful.

Systems Accepting Limited Payment Methods

Small businesses are no longer limited to payment methods like cash, check, and credit card. Today consumers have several ways to pay for their purchases, each with a level of convenience and security. If your point-of-sale system doesn’t allow for payments via Apple Pay, Samsung Pay, or even PayPal, you’re missing out on potential sales. The more payment methods your business accepts, the wider range of customers you can serve and the more satisfied they will be.

Old-School Cash Registers

Not so long ago, small businesses relied on traditional cash registers to not only hold their cash, but also to run reports at the end of the day to show revenue. Although these were once state-of-the-art, they’re now antiquated and super slow. Traditional cash registers require a lot of input from the user, have a huge margin for error and are productivity-killers through repeated entries. Fortunately, new point of sale technology eliminates these inefficiencies and keeps track of sales automatically with every unit sold. Instead of pushing a complicated series of buttons to figure out how much you’ve sold, you can get update and accurate information through real-time reporting.

Separate Machines for Cash and Credit Cards

The notion that you need separate technology to process sales for credit cards is a thing of the past. Although credit card sales were once a small portion of the overall sale and were processed separately from cash and check sales, this is no longer the case. Today’s point of sale systems can process any payment, which makes it easier and faster for you to process transactions for your customers.

Small businesses around the world are taking advantage of today’s new technologies to make their operations better, smoother, and more profitable. Ditching antiquated checkout tools is the first step in making business– from your sales to your reports – more streamlined.